The firearms and ammunition industry in the U.S. is extremely profitable. There are an estimated 100 million gun owners in the U.S. and the industry generated more than $63 billion in revenue in 2020. However, despite the fact that the firearms industry is a billion-dollar industry, most major banks and financial institutions refuse to provide merchant services to firearms dealers because this is considered a high-risk industry.

The firearms industry is considered high risk due to several factors including the high average transaction amount, high chargeback rate, theft risk, and liabilities with background checks. While many major banks and financial institutions will not work with firearms dealers, there are payment processers who are willing to work with businesses within this lucrative industry. It is important for firearms dealers and other related businesses to work with a merchant service provider they can trust to ensure safe and efficient payment processing.

This guide discusses why financial institutions consider businesses in the firearms industry high-risk and how you can find a merchant service provider for your business within this industry. At First MCS, we provide merchant account services for hard to place businesses such as firearms dealers in the Chicago, IL area.

What Makes the Firearms Industry High-Risk?

The firearms industry may be a lucrative industry, but it is also a polarizing one. There is a never-ending debate on gun control in the U.S. with passions running high on all sides of the debate. This gives the industry a certain reputation among much of the population that immediately makes businesses within this industry off putting to major banks and financial institutions.

There are several other reasons that businesses within the firearms industry are considered high-risk including high-ticket sales, fraud risks, and concerns surrounding legality and background checks. Businesses within this industry must find a payment processor willing to work with hard to place merchant accounts.

The following are the main reasons the firearms industry is considered high-risk:

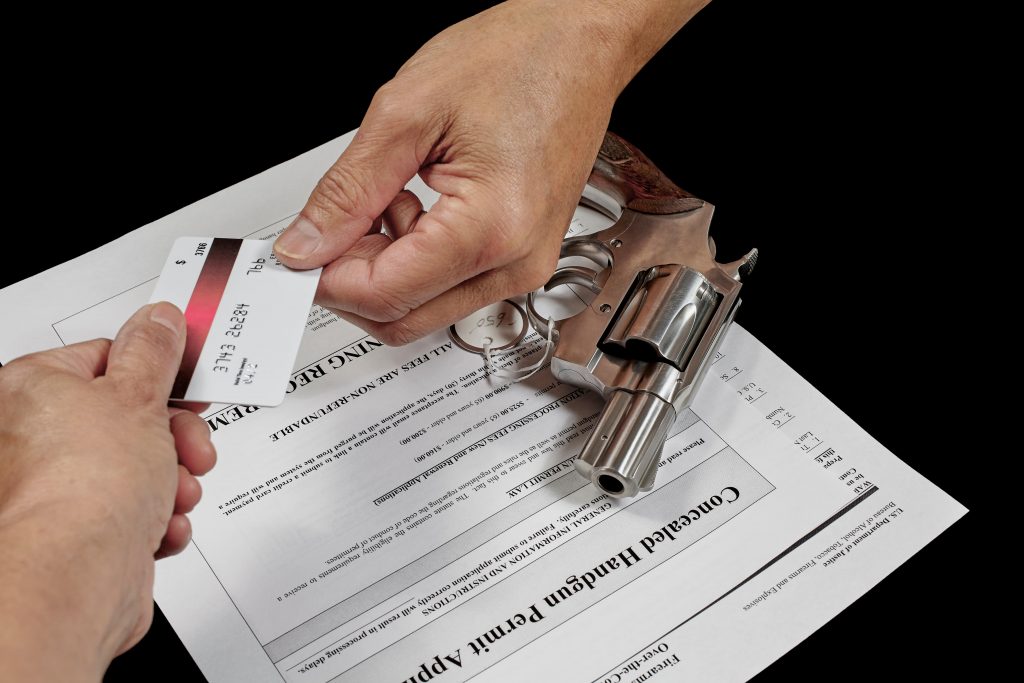

- Legality: Gun laws on the sale, purchase, and ownership of firearms are generally decided by state and local governments and the laws vary widely. Some states are more strict than others concerning concealed carry licenses and what people can own. Illinois requires people to apply for and receive a FOID card before they can legally purchase and own a firearm while most states do not have anything like this. The inconsistency of gun laws at the state and municipal level is one reason major banks consider this industry high-risk. The heavy regulation of gun sales also requires additional insurance underwriting that traditional payment processors would rather avoid.

- Age restrictions: Under the Gun Control Act (GCA), individuals 18 years of age and older can purchase shotguns and rifles, as well as ammunition for shotguns and rifles. Individuals must be at least 21 years old to purchase all other types of firearms and ammunition. If a firearms dealer does not follow age restrictions, they could end up in legal trouble.

- Background checks: It is required by federal law for licensed firearms dealers to do criminal background checks for all firearms sales and transfers. If background checks are not done properly, this could create a legal issue. This law does not apply to unlicensed sellers which makes them an even higher risk for merchant services.

- Reputational risk: As mentioned above, the firearms industry is polarizing. Major banks and financial institutions may fear a hit to their reputation if they work with businesses in this industry.

- High chargeback rates: The firearms industry has a high chargeback rate mainly due to the fact that firearms are high-ticket items. The high cost of firearms makes it more likely for customers to dispute their charges which causes businesses to take a financial hit. Traditional merchant account providers prefer to avoid businesses with high chargeback rates.

- High risk of fraud: The high prices of guns and regulations in place for gun purchase and ownership give the firearms industry a higher risk of fraud than most. People may make fraudulent payments for expensive items and others may try to defraud the background check process to skirt the law and get their hands on a firearm.

Finding Merchant Account Services for Firearms Businesses

There may be a few traditional financial institutions who are willing to work with certain businesses within the firearms industry, but they will likely charge higher rates or only offer restricted accounts. It is best for firearms businesses to work with a merchant account provider that has experience working with other hard to place merchant accounts. Payment processors like First MCS provide merchant account services that cover every aspect of your business at a more reasonable cost.

It is very important to find a merchant account provider to cater their services to the specific needs of your business. This includes payment processing that gives your customers multiple payment options as well as security to prevent fraud and protect customer data. With many merchant account services willing to work with firearms businesses, you will be able to accept major credit cards as payment.

The following businesses in the firearms industry will benefit by working with a payment processor that specializes in hard to place merchant accounts:

- Firearms retailers and distributors

- Pawn shops that sell firearms

- Gunsmith shops and stores

- Gun shops and shooting ranges

- Gun resellers

- Firearm accessory sellers

- Online firearms sales

- Tactical gear sellers

- Gun academies

What to Do When Looking for Merchant Services for Firearms Industry

Your business needs to find a merchant service provider that accommodates your needs and makes the most sense for your budget. The following steps will help prepare your business for merchant services and help you find the right provider:

- Obtain a Federal Firearms License (FFL) if you do not already have one and make sure you understand the rules and regulations regarding sales, transfers, and possession of firearms, ammunition, and accessories at the municipal, state, and federal levels.

- Have your credit report and other financial documents in order to establish a history of credibility.

- Do not choose a payment processer that asks few questions about your business and offers account services at a low cost. Make sure payment processers have experience with firearms businesses and check their ratings with Consumer Affairs and the Better Business Bureau (BBB).

- Check reviews of merchant service providers from a reliable source. Good reviews will show that they are a reliable payment processor that can work with businesses in your industry. Make sure to avoid payment processors with bad reviews.

- Choose a merchant account service that has experience working with businesses in the firearms industry and understand your business model. Payment processors with this experience will be able to better tailor their services to suit the specific needs of your business. They will also likely have stronger relationships with FFL friendly banks and credit card processers which will allow you to accept major credit cards as payment.

Hard to Place Merchant Account Services from First MCS

The firearms industry is a multi-billion-dollar industry which makes safe and efficient payment processing a must for businesses within this industry. However, this industry is considered high risk due to differing state laws on the sale and ownership of firearms, high chargebacks, and reputational risks. Businesses in the firearms industry can get the payment processing services they need by working with a provider like First MCS that has experience with hard to place merchant accounts.

At First MCS, we are prepared to work with businesses in the firearms industry to ensure safe and efficient payment processing. We provide point of sale (POS) terminals and software that allow you to safely take multiple forms of payment. You can also count on us to provide 24/7 customer support so your payment system is never down long when a problem occurs.

For more about how are hard to place merchant services can benefit firearms businesses, call First MCS at (866) 673-3099.